Personal Loan Finder — Your Go-To Free Personal Loan Comparison Platform

How to use Personal Loan Finder?

Submit your online loan application via Singpass or a simple form

Receive tailored personal loan offers

Compare personal loan offers — use our personal loan calculator to budget effectively

Disclaimer: The interest calculation is based on the reducing balance method. Actual repayment amounts may vary depending on the loan tenure, amount, and disbursement date. This is for illustration purposes only and does not constitute a loan offer.

- Fast approval

- No credit score discrimination

- Same-day loan disbursement available

- No minimum loan amount

- Max. loan amount of up to 6x monthly income if you earn at least S$20,000 per year regardless of nationality

- Max. loan amount of S$3,000 for Singaporeans and PRs earning less than S$20,000 per year

- Max. loan amount of S$3,000 for foreigners earning S$10,000–S$19,999 per year; S$500 for foreigners earning less than S$10,000 per year

Eligibility:

- Aged 18 and above

- Must have a consistent source of income

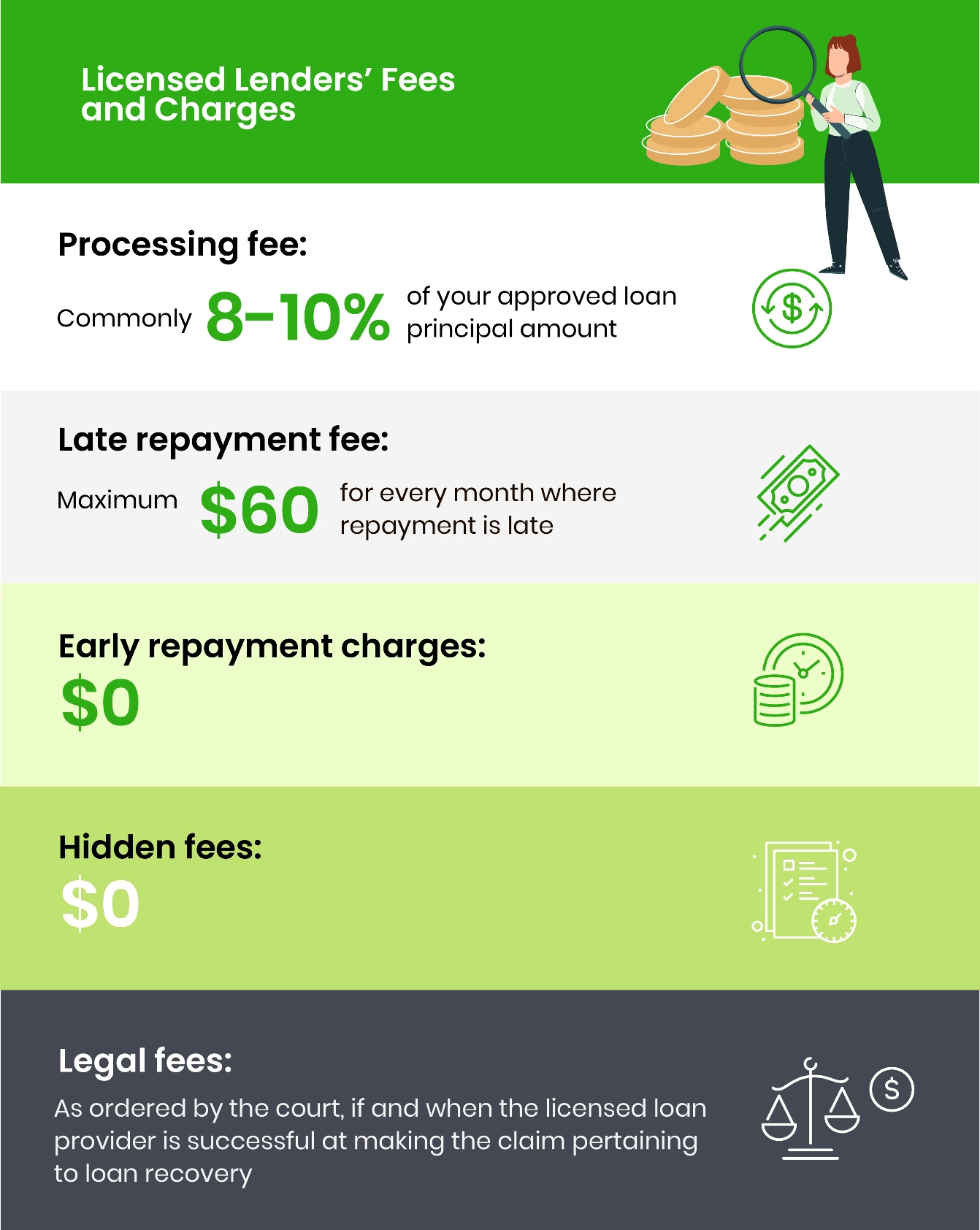

Fees:

- Processing fee: Up to 10% of the loan principal when the loan is granted

- Late repayment fee: Up to S$60 for each month of late repayment

- Legal costs: Ordered by the court for a successful claim by the money lender for the recovery of the loan

- Early repayment fee: N/A

Who Are We?

Personal Loan Finder is a loan-matching platform that connects borrowers with pre-vetted licensed money lenders in Singapore.

Every carefully curated loan provider listed on our platform is responsible, professional, and compliant, and has been personally verified by our team through in-person office visits, during which they are required to present their valid moneylending licences.

Online scams and unlicensed loan providers are increasingly common in today’s digital landscape. Many victims fall prey to these traps due to a lack of knowledge or experience in distinguishing legitimate lenders from illegal ones. Our platform was built to solve this problem.

Personal Loan Finder is committed to helping you pinpoint the best personal loan in Singapore from authorised money lenders for your needs. We’re a member of the Singapore Fintech Association (03/26).

What Do We Offer?

Personal Loan Finder offers utmost convenience when it comes to helping you suss out the best personal loan and best personal loan lender for your unique circumstances.

Our easy-to-use online platform grants you a quick and easy way to compare personal loans in Singapore and get hold of the loan that’s right for you from one of the best private, legal personal loan lenders in Singapore.

Why Choose Us?

Get customised personal loan offers from multiple professional, compliant licensed lenders with just one simple online form submission

Save time with paperless application submission using Singpass Myinfo

Our loan-matching platform is completely free-of-charge

All loan packages are legitimate and non-obligatory

Social Proof

As someone applying for a personal loan for the first time, I was honestly nervous about the whole process. But Personal Loan Finder made it super easy as I was able to compare all the available loan options in one place without feeling overwhelmed. I found a great rate and was approved in 24 hours. Highly recommend it if you are new to borrowing!

J. Koh

I needed a personal loan to pay for a professional development course, and Personal Loan Finder helped me do it without stress. I could instantly see which lenders offered the best terms for my situation, and I appreciated being able to filter by repayment terms and interest rates. It saved me a ton of time.

Soh K.C

I have taken out a few personal loans over the years, and I wish I had known about Personal Loan Finder sooner. Being able to compare loan offers side by side made all the difference. It is fast, transparent, and saved me money by helping me find a lower interest rate than what my bank offered.

Tyler Lee

What are the interest rates on personal loans offered by Personal Loan Finder’s loan partners?

Our licensed loan partners can charge a maximum interest rate of 4% monthly on personal loans. For the most part, the interest rate hovers around 1-4% usually. As interest rates on personal loans vary, it is wise for you to comparison-shop in order to get the best personal loan deals.

What fees and charges can I expect from Personal Loan Finder’s loan partners?

There’s a range of fees and charges you should be aware of, especially if it’s your first time getting a personal loan from a licensed lender:

How much can I borrow on a personal loan?

You may borrow up to 6 times your monthly salary, regardless of your nationality or income level.

What is the repayment term of a personal loan?

The repayment term or loan tenure of a personal loan from a private, legal personal loan lender in Singapore is typically 3 to 12 months. Should you require a longer repayment period, some licensed loan providers are happy to discuss and offer one that’s as long as 24 months.

Is Personal Loan Finder a lender?

No, Personal Loan Finder is not a lender. Think of us as your exclusive personal loan finder-cum-comparison tool.

Is Personal Loan Finder licensed?

Personal Loan Finder is not a lender hence does not require a licence to do what we do — we are a personal loan comparison and matching platform, and a proud member of the Singapore Fintech Association (03/26).

Personal Loan Finder operates in strict compliance with local regulations. All loan providers on our platform are licensed under the Ministry of Law and have been individually verified by our team to ensure they meet regulatory standards.

Rest assured the loan providers we work with to provide you with bespoke personal loan interest rates and packages are all fully legal and authorised to conduct the business of moneylending in Singapore. They are the cream of the crop in the competitive industry.

Why should I use Personal Loan Finder instead of a bank or a single loan provider?

To save time, make things easier for yourself, plus get the best bang for your buck!

Using Personal Loan Finder saves you time and effort by allowing you to compare multiple loan offers in one place — for free. Instead of approaching different loan providers one by one and spending a copious amount of time on that, you can simply submit a single request to receive tailored offers from verified, licensed loan providers in no time.

Plus, our application form is integrated with Singpass Myinfo. For maximum speed and accuracy, simply log in with Singpass and grant authorisation to have your identity and income details auto-filled. This streamlined process ensures a quicker and error-free loan submission altogether.

Why do we do what we do? Well, it’s simple — we believe in comparison-shopping, so you can make an informed decision on your own terms.

After all, every loan comes with its own terms, conditions, and cost; it’s certainly worth weighing your options before committing!

**Disclaimer: Personal Loan Finder is an online platform built specifically to help you easily compare personal loans across different loan providers in Singapore. Our services are completely free-of-charge with no strings attached. All personalised loan packages that you receive from our partners are all legal and non-obligatory. You may proceed at your own discretion. By submitting your loan request with Personal Loan Finder, you agree to share your information with our partner loan providers for the sole purpose of processing and crafting your bespoke loan packages.